A Biased View of Fortitude Financial Group

A Biased View of Fortitude Financial Group

Blog Article

The smart Trick of Fortitude Financial Group That Nobody is Talking About

Table of ContentsSee This Report on Fortitude Financial GroupFortitude Financial Group Fundamentals ExplainedGetting My Fortitude Financial Group To WorkThe smart Trick of Fortitude Financial Group That Nobody is DiscussingThe Facts About Fortitude Financial Group Uncovered

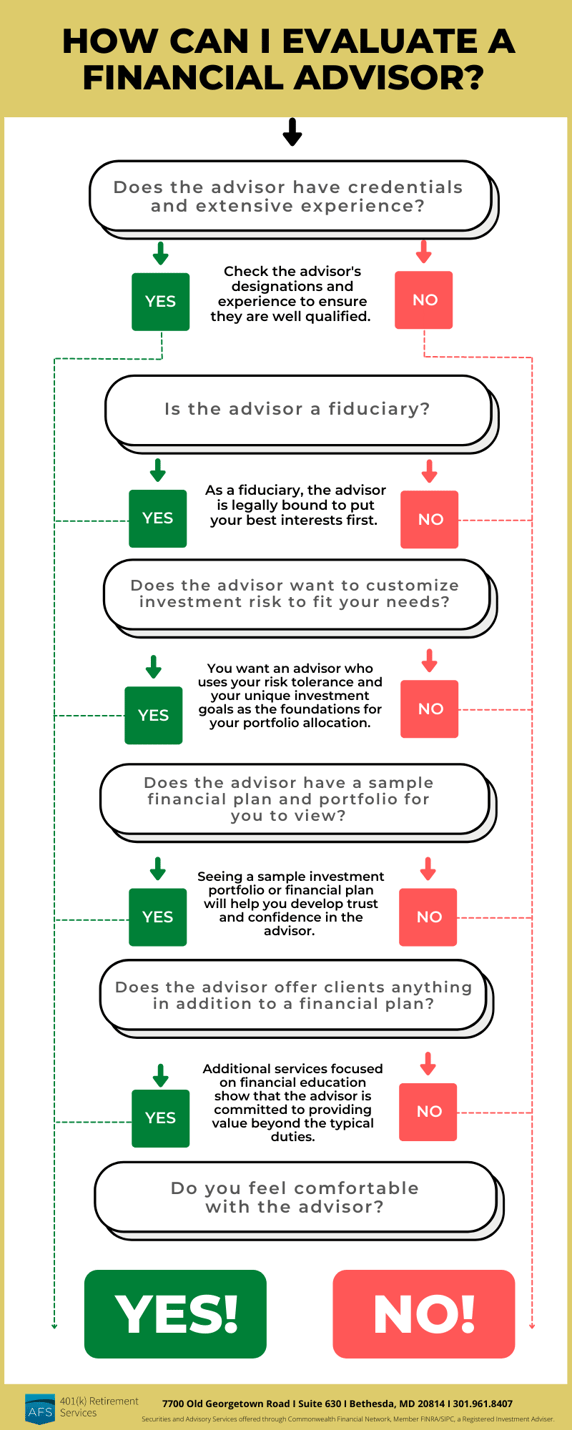

Essentially, a monetary advisor aids individuals manage their cash. Typically, there is a spending element to their solutions, however not always. Some economic consultants, typically accounting professionals or lawyers that specialize in trust funds and estates, are riches managers. One of their primary features is safeguarding client riches from the internal revenue service.Normally, their focus is on educating clients and providing threat management, money circulation analysis, retired life planning, education and learning preparation, investing and much more. Unlike lawyers who have to go to legislation college and pass the bar or medical professionals who have to go to medical school and pass their boards, financial consultants have no details special demands.

If it's not with a scholastic program, it's from apprenticing at a monetary consultatory company. As kept in mind previously, however, lots of advisors come from various other fields.

Or possibly somebody who manages properties for an investment firm decides they would certainly instead aid people and service the retail side of the company. Numerous economic advisors, whether they already have expert degrees or otherwise, undergo certification programs for even more training. An overall monetary expert qualification is the certified economic organizer (CFP), while an innovative variation is the legal economic consultant (ChFC).

Some Known Questions About Fortitude Financial Group.

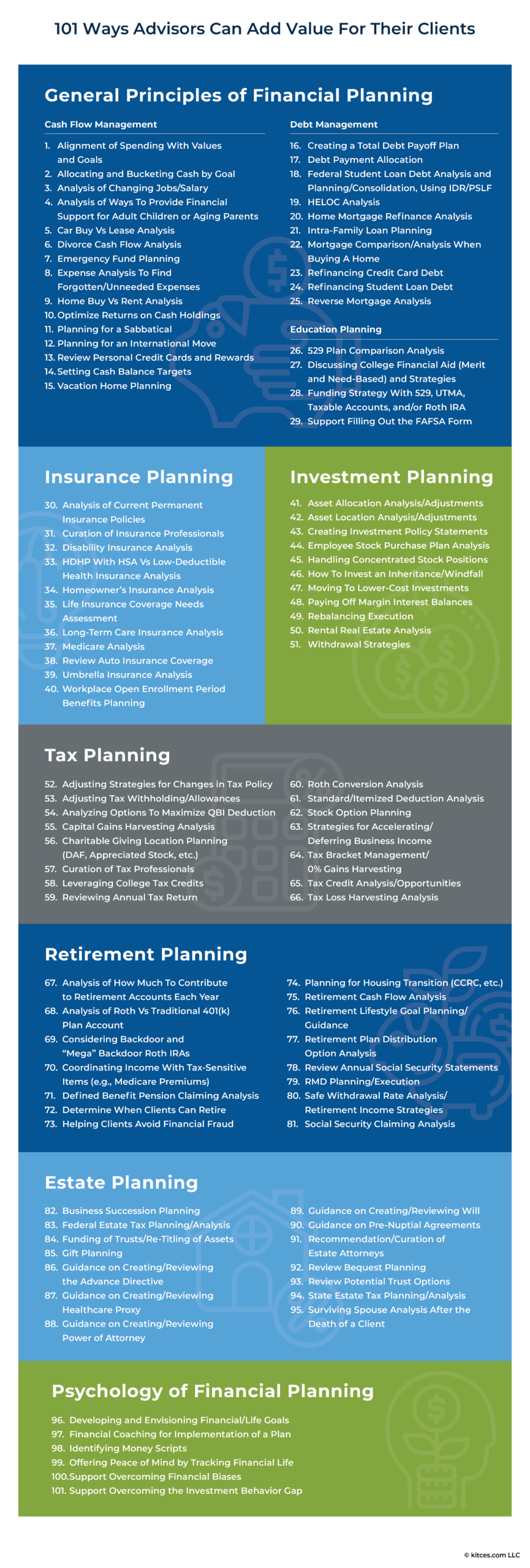

Usually, a financial expert uses financial investment management, economic planning or wide range monitoring. Investment management consists of making your financial investment strategy, implementing it, monitoring your profile and rebalancing it when needed. This can be on a discretionary basis, which suggests the advisor has the authority to make trades without your approval. Or it can be done on a non-discretionary basis whereby you'll need to accept individual trades and decisions.

It will certainly detail a collection of actions to require to achieve your monetary goals, consisting of a financial investment strategy that you can execute on your own or if you desire the advisor's help, you can either hire them to do it when or enroll in ongoing administration. Financial Services in St. Petersburg, FL. Or if you have particular requirements, you can work with the consultant for financial planning on a project basis

Fortitude Financial Group for Beginners

This indicates they must put their customers' ideal passions before their own, to name a few points. Other economic advisors are participants of FINRA. This has a tendency to imply that they are brokers that likewise give investment suggestions. Instead of a fiduciary requirement, they must comply with Policy Benefit, an SEC guideline that was implemented in 2019.

Their names usually state all of it: Securities licenses, on the various other hand, are a lot more concerning the sales side of investing. Financial consultants that are additionally brokers or insurance coverage agents tend to have safety and securities licenses. If they straight purchase or offer supplies, bonds, insurance products or provide monetary recommendations, they'll need particular licenses connected to those items.

The most popular safeties sales licenses consist of Series 6 and Collection 7 designations (https://ameblo.jp/fortitudefg/entry-12865115246.html). A Collection 6 permit permits a financial consultant to market financial investment products such as shared funds, variable annuities, device financial investment trusts (UITs) and some insurance items. The Collection 7 license, or General Stocks certificate (GS), allows an advisor to offer most sorts of safety and securities, like common and recommended stocks, bonds, choices, packaged investment items and even more.

Some Known Facts About Fortitude Financial Group.

Constantly make certain to ask regarding monetary consultants' fee schedules. To find this info by yourself, visit the company's Type ADV that it submits with the SEC.Generally speaking, there are two sorts of pay structures: fee-only and fee-based. A fee-only advisor's sole form of payment is through client-paid fees.

, it's crucial to understand there are a selection of compensation approaches they might utilize. (AUM) for handling your money.

Based upon the aforementioned Advisory HQ research, rates usually range from $120 to $300 per hour, often with a cap to exactly how much you'll pay in total amount. Financial consultants can earn money with browse this site a dealt with fee-for-service design. If you desire a fundamental financial plan, you could pay a flat fee to get one, with the Advisory HQ research study highlighting average rates differing from $7,500 to $55,000, depending on your asset tier.

Fascination About Fortitude Financial Group

When an expert, such as a broker-dealer, sells you an economic item, he or she gets a certain portion of the sale amount. Some monetary specialists that benefit large broker agent companies, such as Charles Schwab or Fidelity, obtain a wage from their company. Whether you need a monetary consultant or not depends upon exactly how much you have in possessions.

Report this page